Understanding Different Types of Home Loans

Understanding Totally different Kinds of Home Loans. Shopping for a house is a big monetary determination for most individuals. It typically requires acquiring a house mortgage to finance the acquisition. Nevertheless, with quite a few forms of residence loans obtainable, it may be overwhelming to grasp which one is the most effective match on your wants. On this article, we are going to discover the several types of residence loans and their options that can assist you make an knowledgeable determination.

1. Conventional Loans

Conventional loans are the most typical kind of residence loans. They aren’t insured or assured by the federal government, making them riskier for lenders. These loans usually require a better credit score rating and a bigger down fee in comparison with different mortgage varieties. Nevertheless, they provide extra flexibility by way of mortgage quantities and compensation phrases.

2. FHA Loans

FHA loans are backed by the Federal Housing Administration (FHA). They’re designed to assist people with decrease credit score scores and smaller down funds to develop into owners. FHA loans have extra lenient qualification standards and decrease rates of interest. Nevertheless, they require mortgage insurance coverage premiums, which enhance the general value of the mortgage.

3. VA Loans

VA loans can be found to eligible veterans, active-duty service members, and their spouses. These loans are assured by the Division of Veterans Affairs (VA) and provide a number of advantages, together with no down fee requirement, decrease rates of interest, and no mortgage insurance coverage. VA loans are a superb possibility for individuals who have served within the army.

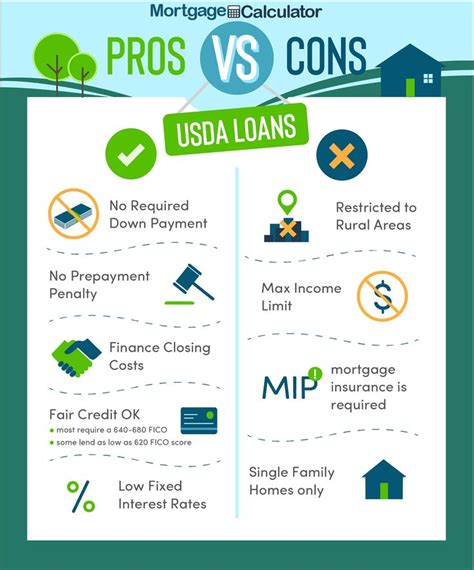

4. USDA Loans

USDA loans are backed by the U.S. Division of Agriculture (USDA) and are designed to assist low-to-moderate-income debtors in rural areas develop into owners. These loans provide 100% financing, that means no down fee is required. USDA loans even have decrease rates of interest and mortgage insurance coverage premiums in comparison with different mortgage varieties.

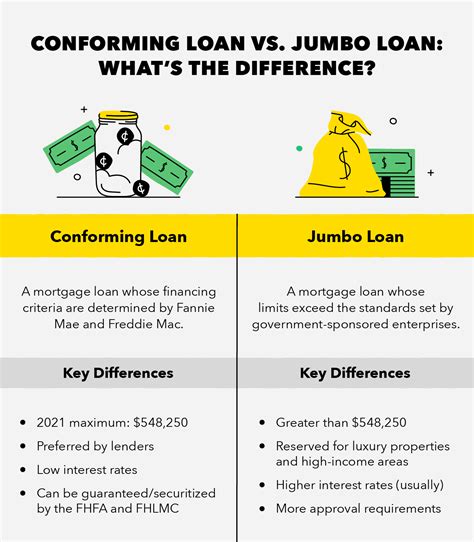

5. Jumbo Loans

Jumbo loans are used to finance high-value properties that exceed the conforming mortgage limits set by Fannie Mae and Freddie Mac. These loans usually have stricter qualification standards, larger rates of interest, and require a bigger down fee. Jumbo loans are appropriate for people buying luxurious houses or properties in costly actual property markets.

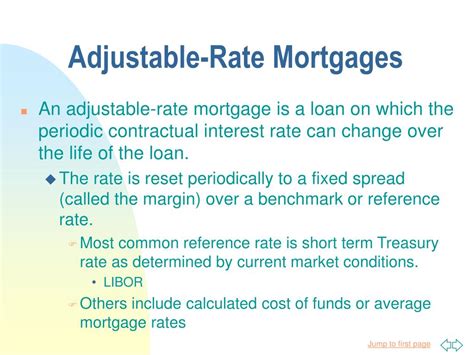

6. Adjustable-Rate Mortgages (ARMs)

Adjustable-rate mortgages (ARMs) have interest rates that fluctuate over time. They normally have a hard and fast fee for an preliminary interval, usually 3, 5, 7, or 10 years, after which modify yearly based mostly on market circumstances. ARMs provide decrease preliminary rates of interest in comparison with fixed-rate mortgages, making them engaging to debtors who plan to promote or refinance earlier than the speed adjustment.

7. Fixed-Rate Mortgages

Fixed-rate mortgages have a relentless rate of interest all through the mortgage time period, usually 15 or 30 years. These loans present stability and predictability because the month-to-month funds stay the identical. Fastened-rate mortgages are perfect for debtors preferring a constant fee quantity and plan to remain of their houses for an prolonged interval.

Conclusion

Selecting the best residence mortgage is essential to make sure a easy and inexpensive homeownership journey. Understanding the several types of residence loans obtainable will help you make an knowledgeable determination based mostly in your monetary state of affairs and objectives. Whether or not you go for a standard mortgage, FHA mortgage, VA mortgage, USDA mortgage, jumbo mortgage, ARM, or fixed-rate mortgage, it is important to contemplate your long-term monetary plans and seek the advice of with a mortgage skilled to search out the most effective match on your wants.

Q&A

- Q: What’s the minimal credit score rating required for a standard mortgage?

- A: The minimal credit score rating required for a standard mortgage is usually round 620, however it could differ relying on the lender.

- Q: Can I exploit an FHA mortgage to purchase a second residence?

- A: No, FHA loans are supposed for main residences solely.

- Q: Are VA loans obtainable to all veterans?

- A: VA loans can be found to eligible veterans who meet particular service necessities.