Understanding Debt-to-Income Ratio and Its Impact on Home Loans

On the subject of making use of for a house mortgage, lenders take into account varied components to find out your eligibility. One essential issue that performs a big position within the mortgage approval course of is the debt-to-income (DTI) ratio. Understanding your DTI ratio and its affect on house loans is crucial for anybody seeking to purchase a home. On this article, we are going to delve into the idea of DTI ratio, its calculation, and the way it impacts your means to safe a house mortgage.

What’s Debt-to-Revenue Ratio?

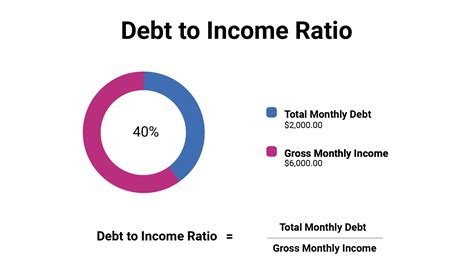

The debt-to-income ratio is a monetary metric that compares your month-to-month debt funds to your gross month-to-month revenue. It’s expressed as a share and helps lenders assess your means to handle further debt, akin to a mortgage cost. To calculate your DTI ratio, add up all of your month-to-month debt funds, together with bank card payments, scholar loans, automotive loans, and another excellent money owed. Then, divide that whole by your gross month-to-month revenue and multiply by 100.

Why is DTI Ratio Essential for Residence Loans?

Lenders use the DTI ratio as a instrument to guage your monetary well being and decide the extent of threat related to lending you cash. A decrease DTI ratio signifies that you’ve got a decrease stage of debt in comparison with your revenue, making you a extra engaging borrower. Then again, a better DTI ratio means that a good portion of your revenue goes in the direction of debt funds, which can increase considerations about your means to deal with further monetary obligations, akin to a mortgage.

Most lenders have particular DTI ratio necessities for approving house loans. Whereas these necessities could fluctuate, a standard guideline is to have a DTI ratio of 43% or decrease. Which means that your whole month-to-month debt funds mustn’t exceed 43% of your gross month-to-month revenue. Nonetheless, some lenders could also be extra versatile and take into account debtors with increased DTI ratios if they’ve robust credit score scores or different compensating components.

Impression of DTI Ratio on Residence Mortgage Approval

Your DTI ratio straight impacts your probabilities of getting authorised for a house mortgage. Lenders sometimes choose debtors with a decrease DTI ratio as a result of it signifies a decrease threat of defaulting on the mortgage. A decrease DTI ratio additionally suggests that you’ve got extra disposable revenue accessible to cowl your mortgage funds.

Let’s take into account an instance for instance the affect of DTI ratio on house mortgage approval:

John and Sarah each apply for a house mortgage with the identical lender. John has a DTI ratio of 35%, whereas Sarah’s DTI ratio is 50%. Each have comparable credit score scores and employment histories. Regardless of these similarities, John is extra more likely to get authorised for the mortgage as a result of his decrease DTI ratio demonstrates higher monetary stability and a better means to handle mortgage funds.

How one can Enhance Your DTI Ratio

In case your DTI ratio is increased than desired, there are a number of methods you’ll be able to make use of to enhance it:

- Repay current money owed: By decreasing your excellent money owed, you’ll be able to decrease your month-to-month debt funds and enhance your DTI ratio.

- Enhance your revenue: Think about taking over a aspect job or discovering methods to spice up your revenue to lower your DTI ratio.

- Keep away from taking up new debt: Decrease new bank card purchases or loans to forestall your DTI ratio from growing.

- Refinance current loans: Refinancing may also help you safe higher rates of interest and scale back your month-to-month debt funds.

Conclusion

Understanding your debt-to-income ratio and its affect on house loans is essential when planning to purchase a home. Lenders use this metric to evaluate your monetary well being and decide your eligibility for a mortgage. Sustaining a low DTI ratio will increase your probabilities of mortgage approval and demonstrates your means to handle further debt responsibly. By paying off current money owed, growing your revenue, and avoiding new debt, you’ll be able to enhance your DTI ratio and improve your prospects of securing a house mortgage.

Q&A

Q: What is taken into account DTI ratio for a house mortgage?

A: Most lenders choose a DTI ratio of 43% or decrease. Nonetheless, some lenders could also be extra versatile and take into account debtors with increased DTI ratios if they’ve robust credit score scores or different compensating components.

Q: Can I get a house mortgage with a excessive DTI ratio?

A: Whereas it could be tougher to get authorised for a house mortgage with a excessive DTI ratio, it’s not unattainable. Some lenders could take into account different components akin to credit score scores, employment historical past, and down cost quantity when evaluating mortgage functions.

Q: How can I calculate my DTI ratio?

A: To calculate your DTI ratio, add up all of your month-to-month debt funds and divide that whole by your gross month-to-month revenue. Multiply the end result by 100 to get the proportion.